Kobe Steel, Ltd.

Kobe Steel, Ltd. announced on April 28, 2016 that it would introduce a Board Benefit Trust (BBT) (hereinafter the “Plan”) for directors, to be established based on a trust agreement concluded with Mizuho Trust & Banking Co., Ltd. The proposal for the Plan was approved at the 163rd Ordinary General Meeting of Shareholders held on June 2016. As details of the Plan have been decided, Kobe Steel hereby announces them as follows.

1. Outline of the Trust

- 1. Name of trust:

- Board Benefit Trust (BBT)

- 2. Trustor:

- The Company

- 3. Trustee:

- Mizuho Trust & Banking Co., Ltd.

(Re-trustee: Trust & Custody Services Bank, Ltd.

- 4. Beneficiaries:

- Directors, etc. who meet the requirements as beneficiaries as stipulated in the director stock benefit regulations

- 5. Trust administrator:

- A third party having no conflicts of interest with the Company

- 6. Type of trust:

- Money trust other than cash trust (third-party beneficiary trust)

- 7. Date of trust agreement:

- August 9, 2016 (planned)

- 8. Date when money is entrusted:

- August 9, 2016 (planned)

- 9. Period of trust:

- From August 9, 2016 (planned) to until the trust ends. (The trust shall continue without a specific ending period, continuing as long as the Plan continues.)

2. Acquisition Details on Company Shares for the Trust

- 1. Type of shares to be acquired:

- The Company’s common stock

- 2. Amount entrusted as acquisition funds for shares:

- 1.1 billion yen

- 3. Acquisition method of shares:

- Acquisition through trading markets

- 4. Acquisition period of shares:

- From August 9, 2016 to August 19, 2016

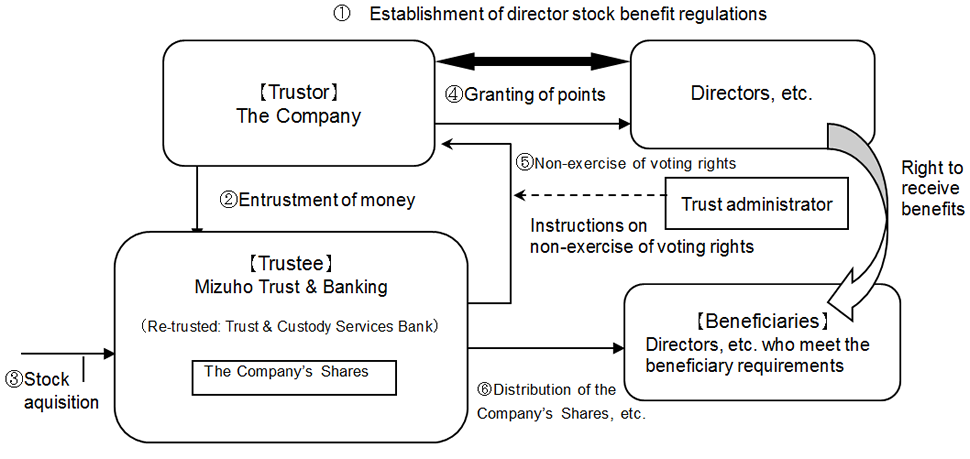

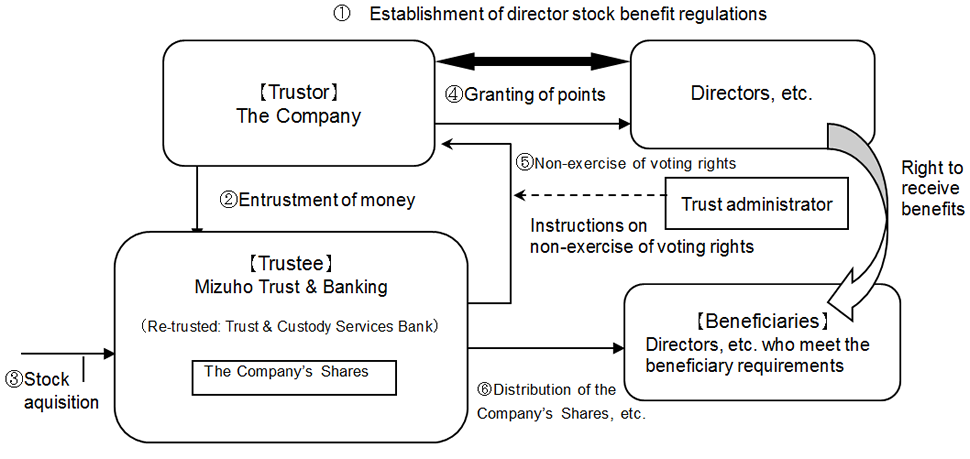

3. Framework of the Plan

-

1.The Company shall at the Shareholders Meeting pass a resolution on the Plan for compensation of directors and establish director stock benefit regulations within the framework of approval received at the Shareholders Meeting.

-

2.The Company shall entrust the money within the amount approved at the Shareholders Meeting as set forth in 1. (The trust established by a money trust is hereinafter called the “Trust.”)

-

3.The Trust shall acquire the Company’s shares through the stock market with entrusted money used as funds, as set forth in 2.

-

4.The Company grants to the Directors, etc. based on the director stock benefit regulations.

-

5.The Trust, in accordance with instructions from the independent trust administrator from the Company, shall not exercise voting rights concerning the Company’s shares in the Trust account.

-

6.The Trust shall provide to those among the Directors, etc. who meet the beneficiary requirements stipulated in the director stock benefit regulations the Company’s Shares based on the number of points granted to beneficiaries in principle every three years on a fixed date during the trust period. However, in the case when Directors, etc. meet the requirements stipulated in the director stock benefit regulations, they shall receive in respect to a certain percentage of the points granted to them an amount of cash equivalent to the market price of the Company’s shares.

(Note) The information on this web site is presented "as is." Product availability, organization, and other content may differ from the time the information was originally posted. Changes may take place without notice.