Kobe Steel introduces special stock incentive scheme through employee stock ownership plan

Jul. 08, 2025

Kobe Steel, Ltd.

Kobe Steel, Ltd. announces that it has decided to introduce a special incentive (market purchase) scheme as a reward system aimed at increasing employee engagement and corporate value over the medium to long term. Under the scheme, all employees who join the Kobe Steel Employee Stock Ownership Plan (ESOP) will be granted shares in the company through the Plan.

1. Purpose of this scheme

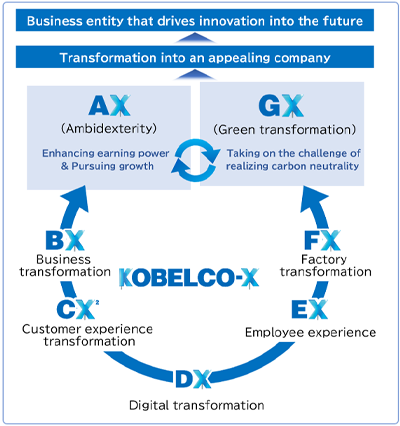

The Kobe Steel Group, also known as the Kobelco Group, is promoting various transformation initiatives, collectively called KOBELCO-X, aimed at transforming into an appealing company as set out in its Medium-Term Management Plan (Fiscal 2024-2026). As part of the efforts, the Group is working to improve employee experience (EX) by actively implementing a wide range of human resources strategies.

Recognizing that employee engagement is a key area of focus to maximize our corporate value over the medium to long term, the Company has decided to provide a special incentive equivalent to 30 shares annually to each member of the employee stock ownership plan with the aim of increasing engagement by raising employees' awareness of their role as stakeholders in the enhancement of corporate management and corporate value. This scheme also intends to foster employees’ shared perspective as shareholders in improving corporate value over the medium to long term.

2. Provision of shares through this scheme

The first provision of a special incentive to those eligible for grant is scheduled for February 2026.

The outline of the ESOP that employs this scheme is as follows.

(as of March 31, 2025)

- (1) Name

Kobe Steel Employee Stock Ownership Plan

- (2) Location

2-2-4 Wakinohama Kaigandori, Chuo-ku, Kobe

- (3) Chair

Norimasa Sasaki

- (4) Number of shares held

4,311,138 shares

- (5) Shareholding ratio

1.09% (Ratio to total number of shares issued)

3. Other notes

The impact of implementing this plan on our consolidated financial results is projected to be minor.

- 1The Company will provide special incentives to eligible employees.

- 2Eligible employees will entrust the special incentives to the ESOP.

- 3The ESOP will use the pooled special incentives to acquire shares in the company through market transactions.

- 4The acquired shares in the company will be allocated to the shares owned by ESOP members and managed by SMBC Nikko Securities Inc., which the ESOP has designated as the stockholding administrator.

- Note: Eligible employees can voluntarily withdraw the shares in the company equivalent to the number of shares held into their personal securities accounts.

Reference: About KOBELCO-X

KOBELCO-X is a collective term of our Group’s seven transformation initiatives aimed at achieving the transformation into an appealing company.

- *The information on this web site is presented "as is." Product availability, organization, and other content may differ from the time the information was originally posted. Changes may take place without notice.