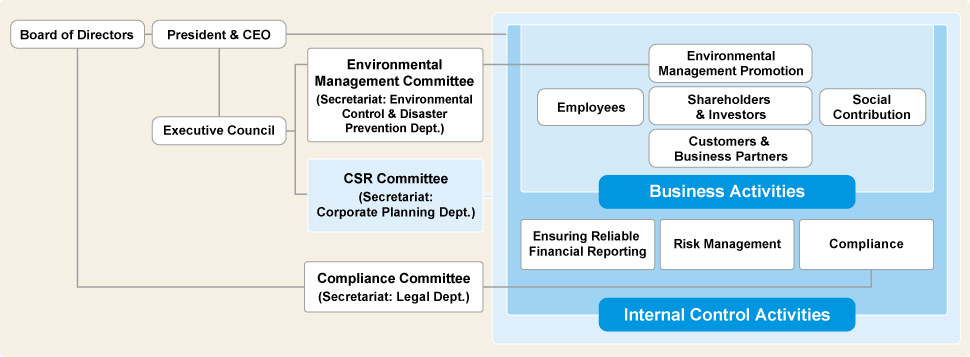

We have established the following promotion structure centered on our CSR Committee, to fulfill our corporate social responsibility (CSR).

CSR Promotion System

In 2006, we established a CSR Committee that is in charge of determining basic policies related to corporate social responsibility and providing centralized implementation.

To facilitate discussion, make proposals and conduct follow-up verification related to important issues, we have also established a Compliance Committee to advise the Board of Directors.

The CSR Committee compiles information concerning CSR activities and publishes it each year in the form of the Kobe Steel Group Sustainability Report.

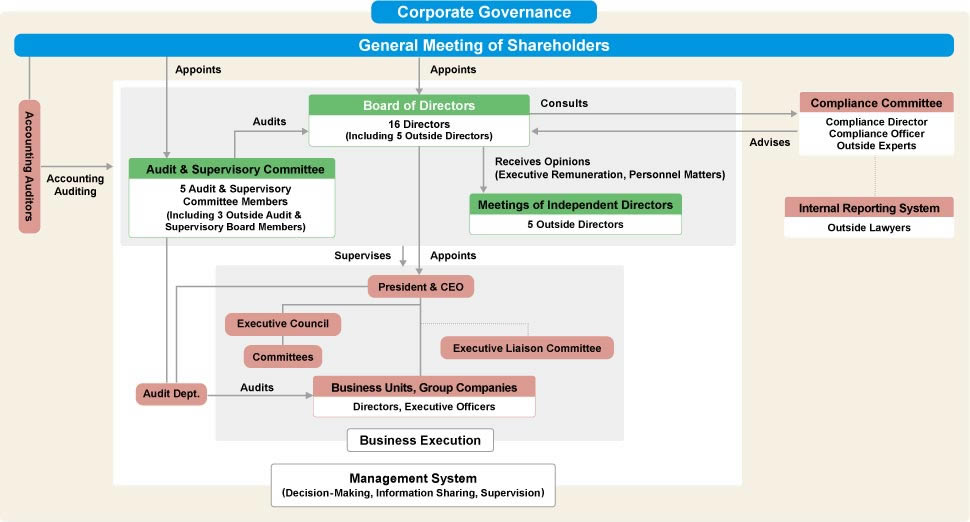

We have strengthened and enhanced our corporate governance system, including transition to a company with an audit and supervisory committee and the establishment of Meetings of Independent Directors.

The Company believes the basis of its corporate value is the promotion of its diversified businesses, composed of various segments with different demand fields, business environments, sales channels and business scales, and the leveraging of that synergy. The Company believes it is impossible to pursue technical development and innovations, which form the foundation for the Company's continued growth, without integrating discussions with the shop floor.

Furthermore, to advance its diversified businesses, the Company believes it is necessary to actively discuss and undertake appropriate decision-making with regard to the risk management of its various businesses and the distribution of management resources as well as to flexibly supervise business executions by the Board of Directors. It is desirable that members with the correct understanding regarding the business execution side attend the Board of Directors meetings, without completely separating supervision from execution.

In line with this approach and in order to ensure comprehensive audits, the Company had chosen to be a company with corporate auditors with investigation authority. Also, to further strengthen the supervisory function of the Board of Directors and to accelerate decision-making with regard to management, on June 22, 2016, Kobe Steel switched to a company with an audit and supervisory committee model, which gives those in charge of audits voting rights on the Board of Directors.

The number of directors (excluding those who are Audit & Supervisory Committee Members) shall be no more than 15 as stipulated under the Articles of Incorporation of the Company. The Board of Directors constitutes an appropriate number of members in light of their diversity and to ensure that directors are able to conduct substantial discussions at the Board of Directors meetings.

The Board of Directors consists of the Chairman of the Board, the President and executive directors in charge of important posts in the head office division, business divisions or the technical development division.

Also, to enhance active discussion, appropriate decision-making and supervision, it is necessary to take into consideration the perspectives of stakeholders, such as minority shareholders, as well to welcome those who can provide objective, fair and neutral perspectives. In principle, several outside directors are appointed to the Board. At present, the Company has appointed five Outside Directors, two of whom are not Audit & Supervisory Committee Members and three of whom are Audit & Supervisory Committee Members.

These Outside Directors (excluding those who are Audit & Supervisory Committee Members) attend Board of Directors meetings every month and provide appropriate advice, taking into account a fair and neutral viewpoint or the viewpoint of stakeholders, such as minority shareholders, as necessary for the Company's continued growth. Outside Directors also play roles to exercise their voting rights at Board of Directors meetings, supervise the Board of Directors meetings, and supervise conflicts of interests between the Company and its executives.

In addition, the Outside Directors serve as members of the Independent Committee established under the Company's Policy on the Large-Scale Purchasing of its Shares. The Independent Committee is convened in the event that a proposal is made for the large-scale purchasing of the Company’s shares. Additionally, a regular meeting of the Independent Committee is held every half fiscal year, and the members gather information on, share the recognition of and talk about the external environment, such as the business climate surrounding each business during the six-month period, overview of businesses, changes in company-related laws and the stock market in recent times. Through these activities, the Outside Directors (excluding those who are Audit & Supervisory Committee Members) who are elected as Independent Committee Members prepare to be able to offer fair, neutral and appropriate opinions to the Board of Directors in emergencies.

Kobe Steel, which is a company with an audit and supervisory committee, has five members on its Audit & Supervisory Committee: two inside and three outside members. This is not only in line with the rules on Audit & Supervisory Committees in Japan's Companies Act, which requires at least three non-executive directors (a majority of which must comprise outside directors), it ensures transparency and fairness and encourages satisfactory auditing for the integrated management of expansive business segments.

In addition, although the Company is not obligated to appoint full-time Audit & Supervisory Committee Members under Japan's Companies Act, the Company enables thorough auditing by appointing full-time inside Audit & Supervisory Committee Members by resolution of the Audit & Supervisory Committee.

Inside Audit & Supervisory Committee Members cooperate with management and the Audit & Supervisory Committee to guide and manage the internal audit division. Outside Audit & Supervisory Committee Members provide specialized auditing knowledge and ensure fairness. To assure best outcomes, outside Audit & Supervisory Committee Members are appointed from legal, financial and industrial fields that enable the provision of specialized knowledge necessary for auditing.

In addition, some Audit & Supervisory Committee Members possess considerable knowledge of finance and accounting to improve the effectiveness of auditing.

The Board of Directors is in charge of carefully discussing and resolving the Company's important business executions and other statutory matters and supervising the business executions.

However, the Company determines standards for deliberation at the Board of Directors meetings so as not to obstruct quick decision-making at the board meetings. The Company delegates authority within a certain scope to persons in charge of carrying out business executions, including the President and other executives.

Additionally, the Company has established a system that can delegate management and promptly make business decisions by appointing executive officers as assistants to directors that execute businesses.

The term for directors (excluding those who are Audit & Supervisory Committee Members) and executive officers shall be one year to enable the Company to quickly respond to drastic changes in the business environment.

The Company has established the "Meetings of Independent Directors" as a forum where the Company appoints its executives, gives hearings to opinions from Outside Directors and provides Outside Directors with information with respect to the management of the Company's business for the purpose of maximizing the roles of Outside Directors.

The Meetings of Independent Directors consist of Independent Directors only. A regular meeting is held every quarter and ad-hoc meetings are held, if necessary.

Executive directors of the Company attend the Meeting of Independent Directors at their discretion and furnish information to and exchange opinions with the Independent Directors thereof.

Furthermore, to encourage information sharing between the Audit & Supervisory Committee, the internal audit division and the internal control division, the Corporate Planning Department serves as the secretariat of the Meeting of Independent Directors and is supported by the Audit Department and Human Resources Department.

Corporate Governance System

The Company has outlined and disclosed its standards for independent directors, outside directors and its policy for determining the qualities a director needs in order to fulfill the mandate from shareholders. The Company selects candidates in line with this policy.

Remuneration for the Company's Directors (excluding Directors who are Audit & Supervisory Committee Members) will consist of fixed compensation, performance-based compensation linked to the achievement of business results targets during individual fiscal years, and medium- to long-term incentive compensation based on stock compensation with the goal of sharing values with shareholders.

* For more details on this corporate governance policy, please refer to the PDF entitled Basic Policy and Initiatives on the Corporate Governance of Kobe Steel, Ltd. on the Corporate Governance page of the Company's website (http://www.kobelco.co.jp/english/) under the About Kobe Steel section.